The Ark Encounter—Refuting Major Myths

In applying for a Kentucky tourism incentive that offers proposed tourist attractions the possibility of receiving a future refund of state sales tax collected at such venues, the Ark Encounter of Answers in Genesis was granted preliminary approval this week by the state.

Kentucky’s Tourism Development Act (TDA) is designed to encourage groups to build tourist attractions in the state and thus draw visitors and their dollars.

Kentucky’s Tourism Development Act (TDA) is designed to encourage groups to build tourist attractions in the state and thus draw visitors and their dollars. Attractions are offered the opportunity to apply for a refund of sales tax that it collects on tickets, food, and merchandise once the facilities are up and running. It is also performance based—i.e., attendance milestones must be reached in order to receive the refund of the sales tax it has collected.

The TDA’s economic motivation is further realized when an attraction generates jobs, adds sales tax to Kentucky’s treasury, and spurs economic development, in this case in Grant County (the site of the Ark Encounter, south of Cincinnati) and the region. The incentive only involves a tourist attraction that is already open and fully operational; no money comes from the state treasury to build the facility. But that fact has been lost on much of the media and bloggers.

The Ark Encounter Will Not Be Built with State Funds

One flagrant misrepresentation of the Ark Encounter’s application to receive refunds of future sales tax comes from The New York Times, which falsely stated that the Ark will be built “with $43 million in state tax incentives.”1 A previous Times’ editorial against the Ark Encounter made the same false claim.2 Letters to the Times that AiG submitted to its editor in order to correct the errors were never printed (even when contacting the paper’s ombudsman to register a complaint). One would think that when a newspaper writes an editorial about an organization and makes an obvious error, then that organization would at least be afforded a 100-word letter to the editor to correct the mistake. Not so with the Times.

The myth that the Ark will be constructed with funds taken from the Kentucky budget is rampant.

The myth that the Ark will be constructed with funds taken from the Kentucky budget (and presumably away from needed state programs) is rampant. The lie gets regurgitated by such anti-Christian media sites like the Huffington Post and Salon, and even by mainstream media like NBC-TV’s Meet the Press earlier this year.

Our publicist’s response to Meet the Press is instructive as to the true nature of the state’s program to draw tourist attractions to build in Kentucky through offering a performance-based refund of sales tax:

Contrary to the man quoted in the piece, we . . . wish to point out that no state funds will be used to build the Ark Encounter. Thus no money will be taken away from funds to fix roads, as the man contended. The tax incentive will not be a grant from the state treasury to help build the Ark Encounter; no money will come out of the state budget and away from state services and programs (e.g., roads/potholes fixed, social services provided, schools funded, etc.).

What are the incentives? Future Ark visitors will pay sales tax at the attraction (e.g., on tickets, food, and merchandise), and at the end of each year of operation, the state will rebate the sales tax to the Ark Encounter if the Ark meets attendance-performance standards and tourism dollars flow into the state. Ultimately, the state’s coffers will benefit tremendously when the Ark opens in Kentucky, as opposed to another state that tried to woo the Ark project.

The part of the sales tax that the state will keep, plus payroll and property taxes collected from the estimated 10,000-plus people who will eventually be working in the region at both the Ark Encounter and other new businesses that will be created, will be significant to the state. Also, the sales tax collected by the many newly created local businesses through the Ark’s ripple effect will also add revenue to the state coffers (e.g., the sales taxes collected by hotels, gas stations, restaurants, etc. in the region).

There is a huge net gain to Kentucky for having the Ark within its borders, and state services will see even more funds, not fewer.

Thank you.

We have been informing the media (and writing frequent articles) that no state monies will be used to construct the Ark, yet the myth continues.

The Tourism Development Act Should Be Nondiscriminatory

Now, for those people who might oppose final approval in a few weeks of the Ark tax refund because of concerns over so-called “separation of church and state” issues, AiG points out that an attorney with the American Civil Liberties Union of Kentucky told USA Today in 2010 that the state’s Tourism Development Act should be non-discriminatory towards the Ark Encounter. This ACLU lawyer stated, “Courts have found that giving such tax exemptions on a non-discriminatory basis does not violate the establishment clause of the First Amendment, even when the tax exemption goes to a religious purpose.”

The most essential hurdle for any governmental incentive program is “neutrality,” meaning that the program must allocate benefits in an evenhanded, nondiscriminatory manner, to include nondiscrimination against religious organizations. In fact, a neutral program must allocate such benefits in spite of, rather than because of, its religious character. The Kentucky tourism sales tax refund program is such a program, and gives neither preference to religious organizations nor precludes participation by them. Indeed, AiG would further suggest that it would be illegal for the state to engage in some form of viewpoint or religious discrimination simply because the content of the Ark Encounter happens to focus on biblical history. In addition, the state is not compelling anyone to visit the Ark Encounter, thus there is no “establishment of religion” with the Ark Encounter and its participation in the tax refund program.

The Ark Encounter will help accomplish what the TDA was designed to do.

The granting of a sales tax rebate is for a legitimate public purpose: the promotion of economic development in Kentucky, which would otherwise not be available if the project were built in another state. The Ark Encounter, courted by other states, decided on building in Kentucky because of the prospect of getting a refund of sales tax through the state's TDA. Offering incentives like a refund of sales tax to draw projects to a state is a common practice.

AiG’s attorney points out that the “state incentive program itself is neutral as to religion.” (You can read the state’s Tourism Development Act for yourself and see if the Ark does not meet the criteria set down.) In fact, regardless of the religious character of the project, one cannot argue that the primary purpose of the state’s tourism incentive is to advance religion. As the Ark brings tourist dollars to the state, the project will also generate thousands of jobs, add sales tax to Kentucky’s treasury, and spur economic development. Simply put, the Ark Encounter will help accomplish what the TDA was designed to do.

The State Is Not Establishing Religion by Approving the Refund

We are happy to report that a spokesperson for Kentucky Gov. Steve Beshear said this week that the governor “is glad the project received preliminary approval today by the [TDA] Authority, and we wish the project success as it continues toward final approval to bring tourism and economic activity to Northern Kentucky.”3

At the same time, however, House Speaker Greg Stumbo told the Herald-Leader newspaper this week that it is not appropriate for the state to provide incentives for the Ark Encounter, alleging that this would violate the so-called “separation of church and state.”4 Contrary to the speaker’s assertion, recent cases in federal court involving the establishment of religion clause of the First Amendment have been generally permissive in matters involving the use of incentive programs to promote economic development, focusing more on the public purpose (jobs, economic development, and so on) rather than on the entity receiving the incentives. The courts have consistently recognized the validity of tax incentives for economic development projects. For example, a 2009 ruling by the U.S. Court of Appeals for the Sixth Circuit (which includes Kentucky) said that as long as such projects endorse “all qualified applicants,” they endorse none of them and, accordingly, do not run afoul of the federal or state religion clauses.5

Representative Brian Linder, R-Dry Ridge (61st Kentucky District, which includes Grant County) expressed his disappointment today over comments made by Speaker Stumbo: “While Kentucky continues to lose jobs to places like Ohio, Indiana, Tennessee, and Texas, Speaker Stumbo chooses to attack an economic development project in my community by encouraging lawsuits on tax incentives.”6 Rep. Linder added, “This project will not only bring jobs to Grant County through employment opportunities at the park, but it will create jobs through new businesses like restaurants, hotels, and other businesses not only in Williamstown but the Northern Kentucky region as a whole. Numerous leaders, including Governor Steve Beshear, are supporting this project because they understand the huge economic benefits it can bring to the Commonwealth, yet Speaker Stumbo would rather stir up issues instead of considering the opportunities this project will provide to Kentucky families.”

There is no establishment of religion with the Ark Encounter and the tax refund being sought.

AiG’s attorney also noted that the state of Kentucky is in no way establishing a specific religious view for its citizens to adhere to. Further, AiG is not a church and is not sponsoring church services. In addition, the state is not compelling anyone to visit the Ark Encounter. Consequently, there is no establishment of religion with the Ark Encounter and the tax refund being sought.

By way of another example, the case American Atheists, Inc. v. City of Detroit Downtown Development Authority involved a revitalization program designed by the City of Detroit to spur downtown revitalization by giving grants to downtown property owners for exterior building renovations.7 The property owners applied for the grants, which, if approved, reimbursed up to 50% of any approved design and construction costs. The American Atheists group challenged the program because three downtown churches were among the owners that had applied for and received the improvements grants. The Detroit program, our staff attorney informs us, was facially neutral, and the grants were available to a wide spectrum of religious and nonreligious groups alike. The program employed a neutral criteria to determine an applicant’s eligibility, what projects could be reimbursed, and how much each grantee received. The Sixth Circuit upheld the program against an Establishment Clause challenge. Like the Detroit program, the Kentucky tourism incentive program is facially neutral and was not established to further religion, but rather to encourage new tourism developments and thus attract new visitors and new tax dollars to Kentucky.

The state’s offer of a sales tax refund does not advance religion. That question has already been answered decisively by the U.S. Supreme Court: “We have held that the guarantee of neutrality is respected, not offended, when the government, following neutral criteria and evenhanded policies, extends benefits to recipients whose ideologies and viewpoints, including religious ones, are broad and diverse.”8

The Tourism Development Act must be neutral in its administration of the state incentives law, and the TDA does not exclude religion as a subject matter for an attraction. In addition, declares AiG’s attorney, “We are confident that we exceed the criteria required by law in Kentucky under the Tourism Development Act.” He added, “The granting of sales tax refunds is for a legitimate public purpose: the promotion of economic development in Kentucky. The project will provide significant jobs, as well as income and sales tax revenue to the state which would otherwise not be available.” In addition, it is performance based. A refund of sales tax is determined by the amount of visitors coming.

The tax refund is to be made available evenly and equally to all takers, including religious groups. There is nothing in the Tourism Development Act (read it here) that even hints at excluding a religiously themed park from applying for the rebate incentive, so it begs the question: by what legal reasoning are Speaker Stumbo and others opposing the tax refund for the Ark Encounter? It seems clear that, whether for political or other reasons, Mr. Stumbo would prefer that the government engage in religious viewpoint discrimination and disregard the neutrality requirement of such programs, in violation of such requirement and the Free Exercise Clause of the U.S. Constitution.

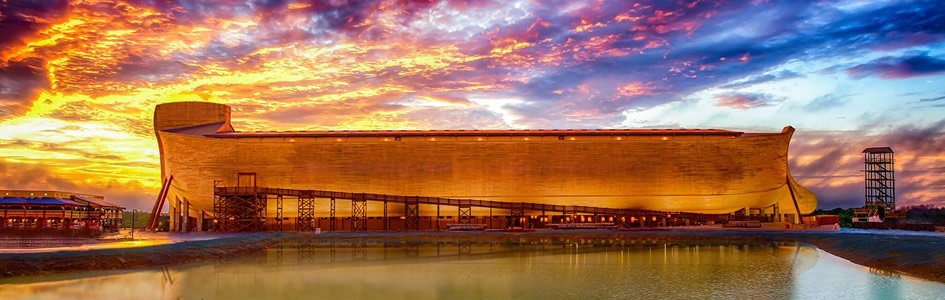

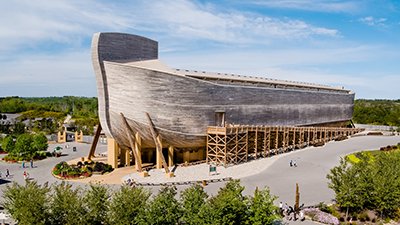

The preliminary approval of the sales tax refund, the imminent arrival of a permit which will allow excavation to start at the Ark site, and a successful bond offering will now permit construction of the $73 million first phase of the Ark Encounter in Williamstown, Kentucky to begin soon.9

Footnotes

- Charles Blow, “Dinosaurs and Denial,” New York Times, December 8, 2012, http://www.nytimes.com/2012/12/08/opinion/blow-dinosaurs-and-denial.html?_r=0.

- “Crossing the Church-State Divide by Ark,” New York Times, May 30, 2011, http://www.nytimes.com/2011/05/31/opinion/31tue4.html.

- Jack Brammer, “Noah’s Ark theme park gets preliminary approval for millions in state tax incentives,” Kentucky.com, July 29, 2014, http://www.kentucky.com/2014/07/29/3356998/noahs-ark-theme-park-gets-preliminary.html?sp=/99/322/&ihp=1.

- Brammer, “Stumbo: State tax incentives for Noah’s Ark theme park violate constitution,” Kentucky.com, July 30, 2014, http://www.kentucky.com/2014/07/30/3358423/stumbo-state-tax-incentives-for.html#storylink=cpy.

- American Atheists, Inc. v. City of Detroit Downtown Dev. Auth., 567 F.3d 278 (6th Cir. 2009).

- Brammer, “Lawmaker takes issue with Stumbo’s critical comments about Ark park,” Kentucky.com, July 31, 2014, http://www.kentucky.com/2014/07/31/3359682/lawmaker-takes-issue-with-stumbos.html?sp=/99/164/329/.

- American Atheists, Inc. v. City of Detroit Downtown Dev. Auth., 567 F.3d 278 (6th Cir. 2009).

- Rosenberger v. Rector and Visitors of Univ. of Virginia, 515 U.S. 819, 839–840 (1995).

- Some significant enhancements have been added to the first phase of the Ark Encounter, and so the initial phase will now cost $86 million.

Recommended Resources

Answers in Genesis is an apologetics ministry, dedicated to helping Christians defend their faith and proclaim the good news of Jesus Christ.

- Customer Service 800.778.3390

- © 2024 Answers in Genesis