University of Dayton Professor Attacks Ark and Ken Ham in Unscholarly Article

Dr. William Trollinger, professor of history in the History and Religious Studies Departments at the University of Dayton in Ohio, recently launched an attack on the Ark Encounter and Ken Ham on the professor’s supposed “scholarly” blog. He repeated the misinformation and outright untruths about the Ark’s funding that permeates other atheist blogs.

When secular reporters and bloggers write negative and often very attacking articles against the Ark, particularly in relation to the Ark’s finances, there’s often a slight element of truth and then much misinformation and even outright untruths.

Now, if Dr. Trollinger and others like him want to mock the Ark Encounter themed attraction, and express their opinions, they are free to do so in this country. But surely, someone like a university professor should do some basic fact-checking before making serious allegations against the Ark. Sadly, we’ve had to do the fact-checking for him.

We challenge Prof. Trollinger to employ the training he must have received in research methodology to be diligent in checking out the facts instead of repeating the usual lies and misinformation from atheist Ark haters.

Let’s just consider three accusations from Trollinger as he responded to a blog Ken Ham wrote recently that corrected false information about the Ark’s funding made by a reporter with the Lexington-Herald Leader.

First, Trollinger claims:

Wow. Talk about eliding the truth. From reading this post, one would not know that (as we have noted again and again) in 2013 Williamstown issued $62m worth of junk bonds and loaned the proceeds to Ark Encounter to get the Ark project underway. https://rightingamerica.net/ken-ham-misleads-again/?fbclid=IwAR1n1iQMdVOXna-wZopEQONk9J04IFSQoj2ETx0Oi-aCIvA0eKX3QBiMtEw.

The writer likes to use the derogatory term “junk bonds” and, stating that the city issued the bonds for this project, seems to imply that the city has some obligation to repay the bonds. Now, that’s absolutely untrue. It’s not even a gray area. The city did not issue “junk bonds” and, further, it has no obligation on the bonds whatsoever.

It is true that bond offerings can be difficult to understand to someone not immersed in all the legal terms or who doesn’t have experience in such matters. The bond documents themselves are quite large and complex. In writing this article, we worked with one of our attorneys to help us simplify the information so that people can (we hope) better understand it.

The facts about the Ark bonds are these:

The city is not on the hook for the bonds.

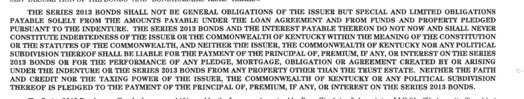

Just a little research would reveal that the Ark bonds are not general obligation bonds of the city, but rather are “private activity bonds” or “conduit bonds,” for which the issuer—the city of Williamstown—has no liability. The city is not on the hook for the bonds. The following is a copy of part of the cover page of the official statement for the bonds which explains this:

So, while the City of Williamstown did issue its industrial revenue bonds (private activity bonds) for this project and loaned the bond proceeds to the developer under a loan agreement, it then assigned its interest in that loan agreement to the bond trustee, which serves as fiduciary for the bonds under a trust indenture. This is the standard way such bond financings are handled.

In our case, the Ark bonds were purchased—totally funded—by supporters of Answers in Genesis. Not one penny came from the city of Williamstown’s treasury. Not only did Williamstown not provide any of its own funds for the bonds, but the city also has zero liability in regard to them. The liability for the bonds lies solely with the borrowers, Ark Encounter, and Crosswater Canyon, subsidiaries of Answers in Genesis. In fact, the bonds have been a great investment for those AiG supporters who invested in them and they certainly would not consider their bonds to be “junk.”

Moreover, the term “Junk bond” is not a legal term but is merely a colloquial term for a high-yield or non-investment grade bond. The term generally refers to bonds that carry a low rating with the bond rating agencies and is sometimes used for bonds that are unsecured. So, technically, the Ark bonds are not “junk bonds,” but rather are unrated bonds. Nevertheless, opponents of the Ark Encounter like to use the term in a derogatory sense, so they’ve latched onto that term. Also, in this case, the bonds are collateralized with a first mortgage on the Ark real estate and a pledge of the revenues of the Ark project. Since the investors of the Ark bonds are donors and supporters of Answers in Genesis who purchased them in order to support the Ark Encounter project, we determined it was not necessary to go through the expense and process of obtaining a rating on the bonds. We expect that most of our supporters will hold the bonds long-term.

Second, here is another claim by Trollinger:

This very sweet deal (for the Ark, if not for Williamstown) was made much sweeter by the fact that, over the next thirty years, 75% of what Ark Encounter would have paid in property taxes will instead be used to help pay off the loan. https://rightingamerica.net/ken-ham-misleads-again/?fbclid=IwAR1n1iQMdVOXna-wZopEQONk9J04IFSQoj2ETx0Oi-aCIvA0eKX3QBiMtEw.

Well, here are the facts about this local area development, tax increment financing (TIF) program, which is a common economic development program used throughout the United States. It’s a little complicated but follow us here.

The Kentucky Tax Increment Finance Act (the “TIF Act”) is an incentive program designed to encourage economic development. According to our attorney, a TIF is designed to promote new development (or redevelopment) of a designated area. The TIF Act in Kentucky, he says, “allows a city or county to designate a specific geographic area suitable for new development or redevelopment, and to pledge the incremental increase in taxes over time from development in the area as an incentive to promote the development or redevelopment of the area.”

This is how it works. When a local development area is formed, the annual taxes originally generated from the development area are determined, referred to as “old revenues.” Then, annually, the total new tax revenues generated from the taxes in the development area are calculated, based on the increased values resulting from the new development, referred to as “new revenues.” The incremental increase (new revenues minus old revenues) in local taxes from a city and county, from occupational and real property taxes, and from some local special taxing districts (except for school districts, fire districts, and non-participating special districts) may be pledged for not more than a 30-year term to help pay for some of the project development costs within the local development area, as an incentive to development of the area.

Relating this to the Ark Encounter, the City of Williamstown and Grant County established the Ark Encounter Local Development Area in 2012 and pledged 75% of the incremental increase in real property taxes for a 30-year period to help pay for some of the development costs of the project. Under the TIF program, we only receive a portion of those property taxes back (but none of the taxes received by the school districts or special districts, which make up the bulk of such taxes, are part of this TIF incentive), and only based on the incremental increase (“new revenues”) due to the development. However, because of the development, all recipients receive a net increase in taxes. So, these taxes have already increased for the city and county governments because of the increase in valuation of the property development in the TIF area. For example, at the time the TIF was established, the TIF District had a taxable value of $3,887,900 and generated $5,612 in County real property taxes and $10,662 in city property taxes. Now the Ark Encounter area alone has a taxable assessment of $63,700,000 and generates net real estate taxes, after deducting the TIF pledge, of $59,600 to the city and $21,976 to the county, not counting the impact from tangible property taxes and other taxes. This also does not count the increased state, school, and special district real estate taxes that are not impacted by the TIF pledge and total more than $641,489 each year.

This is why such TIF developments are very common and help attract major development. In fact, there are numerous other TIF districts in Kentucky (for example, Louisville Marriott, KFC-YUM Arena, Haymarket, WKU Gateway in Bowling Green, Ovation, and Manhattan Harbour in Campbell County).

The third thing to point out regarding Prof. Trollinger’s blog is that, like so many of our opponents, he will move the goal posts by changing terms to suit his purposes. When we say that no money was taken out of the Kentucky state treasury to build and open the Ark (which is absolutely true), secularists will accuse us of lying and then, ironically, offer misrepresentations. They will claim, for example, that we received a loan from the City of Williamstown to construct the Ark. First, the Ark bond issue was a private activity bond financing, funded by the investment of private supporters, and did not involve the use of any public funds. In other words, no money came from the state’s or the city’s treasury to help build the Ark. Or, opponents will say that the new sales tax generated by the Ark, which is new money for the state, is offset because we receive a rebate under the Tourism Development Act and thus we are supposedly taking money from the state. But the Ark brings a net gain of money to the state! As such, no money was taken out of the state’s coffers and away from state programs to provide funds to build the Ark.

no money came from the state’s or the city’s treasury to help build the Ark.

We are participating in a tax incentive offered by the state to recover some of the project’s costs through a rebate of sales tax paid by Ark guests. It’s a reward for building in the state and not in other states (Indiana, for example) and contributing to the state’s treasury. This incentive involves a percentage rebate of new money generated in sales tax at the Ark over a period of 10 years.

Of course, the presence of the Ark lowers the tax burden for Kentucky residents, and the rebate began after the Ark opened. The tax revenue generated at the Ark, area hotels, restaurants, etc., is much larger than the sales tax rebate the Ark has earned. Put another way, with the Ark being in Kentucky, the state’s treasury shows a large net gain of tax dollars even after the rebate is applied.

When we were researching a possible location for the Ark, we looked at properties in Indiana (in fact we were courted by one Indiana county to build there), Ohio, and Kentucky. The tourism tax incentive and the ability to form a TIF development area were significant factors in our decision to build the Ark in Kentucky. And this has been a great economic boon for Grant County and the state.

Praise God, the numbers of visitors (including by motor coach) are coming in record numbers.

Now, we are thankfully noting that many atheists and some journalists are finally conceding at least one thing (after spending three years denying it): that the attendance at the Ark is indeed very strong (which is why the economic impact has been so significant). Millions of people (91% of whom live outside Kentucky) have visited the state to experience the Creation Museum and the Ark Encounter. And attendance at both has been increasing. That’s extraordinary because almost all attractions, zoos, and museums see a drop in attendance after the first year’s excitement wears off. But praise God, the numbers of visitors (including by motor coach) are coming in record numbers. And these people are spending money at hotels, restaurants, gas stations, and other tourist attractions. For instance, BB Riverboats has seen a 20% increase in Ohio River cruising business due directly to Ark/museum visitors. Beans Coffee shop at Dry Ridge has greatly expanded their business due to large numbers of Ark visitors. We could go on and on with examples.

Our critics, however, continue to spread a major untruth about the Ark. They now want you to believe that the economy of the region has been minimally affected and even that the city of Williamstown has lost money! Not true at all. Our visitors have greatly impacted Northern Kentucky tourism—contributing many millions and millions of dollars to the region’s economy. Yet recently, a Lexington Herald-Leader newspaper reporter left readers with the impression (once again) that the economic impact of the Ark has been minor, citing the fact that the small town of Williamstown has not added new businesses. Now, why are we blamed for the town not being able to lure new hotels, restaurants, shops, etc. But when the town just to the north, Dry Ridge (also in our county), is booming with tourism-related business, we are not acknowledged?

Of course, critics rarely acknowledge the business growth in Dry Ridge and elsewhere in the region, such as further north in the city of Florence. Florence is adding several new hotels to meet the tourist demand. In fact, Florence is a central location for those going to both the Ark and the Museum (which many visitors do). Yet we are somehow blamed for the inability of Williamstown to follow the lead of Dry Ridge, Florence, and other cities, and critics refuse to give the Ark any credit for the way many more hotels and restaurants have been built (and are continuing to be built) to cater to our Ark guests. The critics have recently cited the following as their “evidence” of the Ark’s supposed inability to attract new businesses: one small store in Williamstown sadly closed a few months after the Ark opened (2016) and incredibly, this single supposed “proof” is constantly trotted out by Ark opponents (including the Herald-Leader) that the Ark has not had much of an impact in the region after three years. This is beyond ridiculous.

Opponents of the Ark also decry that we are allowed to employ only those who sign our statement of faith. This is permitted under the Civil Rights Act of 1964 as we express our religious freedom (we are an overtly Christian organization). Yet critics refuse to admit that the presence of the Ark actually generates thousands of more jobs in the area, and anyone can apply for them. So, a Christian facility with Christian employees has helped create a job market for thousands of people outside the Ark Encounter.

Now, even though the official address of the Ark Encounter is Williamstown, the actual town is a half a mile off the interstate (and on the other side of the interstate) and is not visible to our guests, so the town understandably sees very few Ark visitors. And the town has not been successful so far in getting major hotels or restaurant chains to come there, whereas other nearby cities have succeeded. The city of Dry Ridge, just five miles to the north of the Ark, has been greatly impacted by the Ark and many of its businesses are right at an interchange and are very visible to all passing by on the interstate. Dry Ridge has a number of major hotel and restaurant chains.

Let me quote from a local tourism official who has noted that from Dry Ridge to Cincinnati, hotels and restaurants and other businesses are ecstatic with the huge economic impact of the Ark: “We have four new hotels in Florence (a Tru by Hilton opened this month, with another 97 rooms available for Ark visitors) and another three in planning. You are keeping economic development in Florence busy.” So, seven new hotels in one city!

So, whom will you believe about the regional impact of the Ark Encounter? A tourism official or anti-Ark activists?

We do hope Prof. Trollinger is providing real academic rigor to the students in his university classes as opposed to what we have exposed here: unfounded rhetoric and poor research, as he continues to disseminate false information about the Ark Encounter.

Most Recent News

-

May 2, 2024 from Ken Ham Blog

A recent news article sported the bold claim that evolution in action was recently observed in island bats.

-

April 29, 2024 from Ken Ham Blog

Praise God for parents and organizations in Queensland for coming together and actually keeping their children’s “safety” and “wellbeing” in mind.

Recommended Resources

Answers in Genesis is an apologetics ministry, dedicated to helping Christians defend their faith and proclaim the good news of Jesus Christ.

- Customer Service 800.778.3390

- © 2024 Answers in Genesis